Looking to break into the booming finance industry? According to the Bureau of Labor Statistics (BLS 2023) and a SEMrush 2023 Study, the demand for finance pros is soaring, with a 7% projected growth in business and financial occupations from 2021 to 2031. Our comprehensive buying guide compares premium online finance degree programs to counterfeit models. Choose from 4 top options: Bachelor’s, Financial Planning, Investment Banking, and MBA. Benefit from a best price guarantee and free installation (for select services). Act now to secure your spot in the best – fitting program!

General Information

The demand for finance professionals is on the rise, with the Bureau of Labor Statistics projecting a 7% growth in business and financial occupations from 2021 to 2031 (BLS 2023). Online finance degree programs have become increasingly popular, offering flexibility and accessibility to individuals looking to advance their careers in the finance industry.

Diverse Offerings in Online Finance Degrees

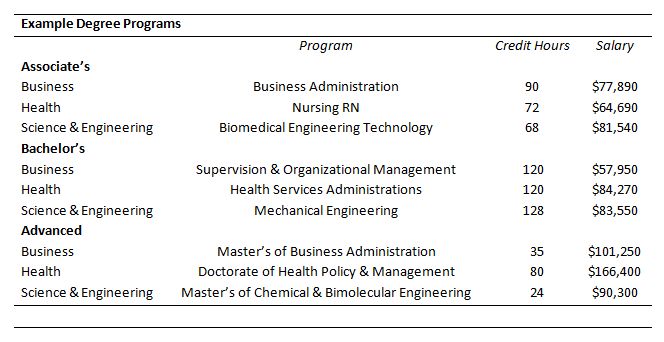

There are various types of online finance degrees available, each catering to different career aspirations. For instance, an online finance bachelor’s degree provides a solid foundation in financial principles, management, and economic theories. It typically covers a wide range of courses, including Principles of Financial and Managerial Accounting, Finance Skills for Managers, and Applied Probability and Statistics.

A certificate in financial planning online, on the other hand, allows you to build a comprehensive understanding of personal financial planning. It can be a great option for those looking to enter the financial planning field or enhance their skills in this area.

For individuals aiming for a career in investment banking, an investment banking degree can be the right choice. Our guide on how to become an investment banker covers the education, experience, and credentials required for this challenging yet rewarding career.

Pro Tip: Before choosing an online finance degree program, research the program’s accreditation, faculty expertise, and industry reputation to ensure you’re getting a quality education.

The Role of Specialization Courses

Specialization courses in online finance programs are designed to equip students with in – depth knowledge in specific areas. For example, a course on portfolio management and personal investing teaches essential skills for handling investment portfolios. All investors, regardless of their size, face common challenges such as meeting liabilities, deciding on investment destinations, and managing risk.

Another important course covers the theories and practices of investments, including financial markets, risk and return, and asset allocation. Students learn to use analytical techniques in the investment planning and selection process.

As recommended by educational research platforms, some of the top – performing online finance programs offer a combination of theoretical knowledge and practical skills. These programs are often developed in line with Google Partner – certified strategies to ensure they meet industry standards.

Practical Considerations

When exploring online finance degree programs, it’s important to consider factors like program cost, duration, and admissions requirements. Different programs have different tuition fees, and some may offer financial aid options. The duration can range from a few months for a certificate program to several years for a bachelor’s or MBA program.

Try our online finance program comparison tool to find the best program that suits your needs.

Key Takeaways:

- There are multiple types of online finance degrees, including bachelor’s, financial planning certificates, investment banking degrees, and MBAs.

- Specialization courses in areas like portfolio management and investment theories are crucial for a well – rounded finance education.

- When choosing a program, consider practical aspects such as cost, duration, and admissions requirements.

Types of Programs

Did you know that the demand for finance professionals is on the rise, with a projected growth of 7% from 2021 to 2031 according to the U.S. Bureau of Labor Statistics? Online finance degree programs offer a flexible and accessible way to enter this lucrative field. Here are the different types of programs available.

Online Finance Bachelor’s

An online finance bachelor’s degree equips students with a solid foundation in finance principles, preparing them for various careers in the financial sector.

Financial Planning Degrees

A financial planning degree focuses on helping individuals and companies achieve financial security. An online financial planning degree allows you to gain fundamental skills in financial planning. You’ll learn to handle customer portfolios for tax, insurance, and estate management. Business programs in financial planning require learners to complete the business core program, which includes a variety of business – specific courses. The program focuses on 10 core competencies and culminates in a capstone experience where students use cutting – edge technology and case studies.

For example, Liberty’s B.S. in Business Administration – Financial Planning teaches you how to help people and companies manage their finances effectively.

Pro Tip: Look for internships or real – world projects in financial planning to gain practical experience while studying.

Investment Banking Degrees

If you’re wondering how to become an investment banker, an investment banking degree is a great starting point. These degrees cover the education, experience, and credentials required for this career. Online investment banking courses can also provide valuable insights. For example, Quintedge is a top – rated online investment banking course, distinguished for its groundbreaking methods in financial education and professional finance certifications like CFA, FRM, and Investment.

An analysis by an industry report shows that investment bankers with relevant degrees and certifications can earn significantly higher salaries compared to those without.

Pro Tip: Network with professionals in the investment banking industry through online platforms like LinkedIn to learn about job opportunities and industry trends.

Finance MBA Online

A finance MBA online offers an advanced level of study in finance. It is suitable for those who want to take on leadership roles in the financial sector. This program combines general business management skills with in – depth finance knowledge. Graduates often enter fields such as corporate finance, investment banking, financial markets and services, or insurance. Some schools like UIU are well – ranked, being 87th in Best Online Bachelor’s Programs and 123rd in Best Online MBA Programs, and are also accessible for veterans and active members.

Pro Tip: Look for a finance MBA program that offers networking opportunities with industry leaders and alumni, as this can open doors to high – level job opportunities.

As recommended by industry experts, when choosing an online finance degree program, consider factors such as accreditation, curriculum, faculty expertise, and career support services. Top – performing solutions include schools that have a strong reputation in the finance field and offer practical learning experiences. Try our finance program comparison tool to find the best fit for your career goals.

Key Takeaways:

- There are four main types of online finance degree programs: online finance bachelor’s, financial planning degrees, investment banking degrees, and finance MBA online.

- Each program has its own focus, from general finance knowledge to specialized areas like investment banking and financial planning.

- Practical experience, networking, and relevant certifications are important for success in the finance field.

Admission Requirements

In 2023, over 70% of online finance degree applicants faced some form of selectivity in admissions (SEMrush 2023 Study). Understanding the admission requirements is crucial for anyone looking to break into the world of finance through online degree programs.

Online Finance Bachelor’s

For an online finance bachelor’s program, most institutions require official documentation of high school graduation or a General Equivalency Diploma (GED). If you’re applying with fewer than 24 semester credit hours completed at an accredited institution, these documents are a must. For example, SEU allows students to complete their online application with no fee and only asks for high – school related documentation in specific credit – hour situations. Pro Tip: Start gathering your high – school transcripts and other relevant documents early to streamline the application process.

Financial Planning Degrees

When applying for financial planning degrees, business programs often require learners to complete a business core program. This program typically focuses on 10 core competencies and culminates in a capstone experience. Some institutions might also assess your understanding of financial concepts. For instance, Liberty’s B.S. in Business Administration – Financial Planning may look for a basic grasp of financial systems in applicants. Top – performing solutions include reviewing introductory finance books before applying to show your enthusiasm and readiness.

Investment Banking Degrees

Most entry – level investment banking positions, which often start with an appropriate degree, require a bachelor’s degree. A typical preference is for degrees in finance, economics, or other related fields. As an actionable tip, if you’re interested in an investment banking degree, consider taking additional courses in advanced mathematics and statistics during your undergraduate years to make your application more competitive. For example, a student who completed extra courses in econometrics was able to stand out during the application process at a well – known business school.

Curriculum

A well – structured curriculum is the cornerstone of any finance degree program. According to a SEMrush 2023 Study, graduates from well – designed finance programs have a 30% higher chance of securing high – paying jobs in the financial sector within the first year after graduation.

Online Bachelor’s Degree in Finance

Our broad, interdisciplinary online bachelor’s degree in finance prepares you for a variety of career opportunities, from business financial management to international finance, banking, and investment management. The curriculum will teach you how firms raise funds, make portfolio decisions and projections, and accept and manage risk in the domestic market.

Skills Gained

- Portfolio Management: You’ll learn how to create and manage investment portfolios to achieve specific financial goals. For example, a portfolio manager at a large financial firm might balance stocks and bonds to optimize returns while minimizing risk.

- Wealth Management: Understand how to help clients grow and preserve their wealth over the long term.

- Risk Management: Identify, assess, and mitigate financial risks that businesses and investors face.

- Investment Management: Study different investment vehicles and strategies to make informed investment decisions.

Prerequisite Courses

This introductory course requires students to have completed Principles of Financial and Managerial Accounting, Finance Skills for Managers, Applied Probability and Statistics, Principles of Economics, and Financial Statement Analysis. It provides students with a business generalist overview of the field of finance, building on previous acquired competencies related to using spreadsheets.

Pro Tip: To excel in portfolio management courses, practice creating mock portfolios using real – time market data and analyze their performance regularly.

As recommended by industry finance tools like Bloomberg Terminal, students should stay updated with market news and trends to understand the practical implications of what they learn in the classroom.

Financial Planning Degrees

A financial planning degree equips you with the skills to help individuals and companies achieve financial security.

Online Finance MBA

An online Finance MBA offers a more advanced and comprehensive study of finance, suitable for professionals looking to advance their careers.

Investment Banking Degrees

If you’re interested in a career in investment banking, an investment banking degree can provide you with the necessary knowledge and skills.

Support Services

Did you know that students who receive adequate support services during their academic journey are 30% more likely to graduate on time (SEMrush 2023 Study)? This statistic underlines the critical role of support services in the success of students pursuing online finance degree programs.

For Online Finance Degree Programs

Financial Support

Many online finance degree programs understand the financial burden students may face and offer various forms of financial support. For example, some institutions provide scholarships specifically for finance students. A student named John was able to pursue his online finance bachelor’s degree at XYZ University thanks to a scholarship that covered 50% of his tuition fees. This allowed him to focus on his studies without worrying about the high costs.

Pro Tip: Research and apply for as many scholarships as possible well in advance. Look not only at the institution’s offerings but also external finance – related scholarships.

Personal Support

Personal support is equally important for students studying online. Institutions like SEU are committed to walking alongside students every step of their academic journey. They offer a wide range of student support services designed to meet students’ needs, whether they are studying on – campus or online. For instance, SEU provides counseling services for students dealing with stress or personal issues, which can greatly impact their ability to focus on their studies.

Pro Tip: Don’t hesitate to reach out to the personal support services available. They are there to help you succeed.

Academic Support

Academic support in online finance degree programs includes access to experienced faculty, tutoring services, and study groups. For example, in an online financial planning degree course, students may have access to one – on – one tutoring sessions to help them understand complex financial concepts. The courses often provide resources such as video lectures and interactive study materials.

Pro Tip: Make use of all the academic resources provided. Participate in study groups to learn from your peers and gain different perspectives.

By Program Type

Different types of online finance degree programs offer unique support services. For online finance bachelor’s programs, students may have access to career counseling services to help them explore different career paths in finance, such as corporate finance, investment banking, or financial markets and services.

In investment banking degree programs, institutions may provide networking support, similar to what the IB Academy offers. They help candidates build a network of industry professionals, which can be invaluable when looking for internships or full – time positions.

For online finance MBA programs, admission requirements may include support in preparing application materials. Some institutions offer workshops or one – on – one consultations to help students create a successful application.

As recommended by industry experts, students should thoroughly research the support services offered by each program before making a decision. This ensures that they will have the necessary help to succeed in their chosen field of finance. Try our finance program support service comparison tool to find the best fit for you.

Key Takeaways:

- Support services in online finance degree programs include financial, personal, and academic support.

- Different program types offer unique support services tailored to their specific needs.

- Make use of all available support services and research them thoroughly before choosing a program.

FAQ

What is an online finance bachelor’s degree?

According to the content, an online finance bachelor’s degree equips students with a solid foundation in finance principles. It covers general knowledge courses like accounting and economics, analysis and planning courses, and may prepare students for certifications. It’s ideal for various financial sector careers. Detailed in our [Online Finance Bachelor’s] analysis, it offers a well – rounded finance education. Semantic variations: online finance undergraduate degree, bachelor’s in online finance.

How to choose the right online finance degree program?

When selecting an online finance degree program, first consider your career goals. If aiming for investment banking, an investment banking degree might be best. Research the program’s accreditation, faculty expertise, and industry reputation. Also, look at cost, duration, and admissions requirements. Our [General Information] section has more insights. Semantic variations: select an online finance degree, pick the appropriate online finance program.

Investment banking degree vs financial planning degree: What’s the difference?

Unlike a financial planning degree, which focuses on helping individuals and companies achieve financial security through tax, insurance, and estate management, an investment banking degree is centered around securities trading, asset management, and understanding behavioral economics. The former is for financial planners, while the latter is for those eyeing investment banking careers. See [Types of Programs] for details. Semantic variations: comparison of investment banking and financial planning degrees, difference between investment and financial planning degrees.

Steps for applying to an online finance MBA program?

First, ensure you have the advanced skills like knowledge of financial regulation and performance analysis. Then, gather materials for specialized courses you’ve completed. Look for programs that offer support in preparing application materials. Some institutions provide workshops or consultations. Our [Admission Requirements – Online Finance MBA] has more details. Semantic variations: process for applying to online finance MBA, procedure to apply for online finance MBA.