Are high gas utility bills draining your wallet? You’re not alone. In the US, many struggle to manage these costs, especially low – income families spending three times more on energy. But don’t worry! The SEMrush 2023 Study shows there are solutions. Premium energy assistance programs like LIHEAP and budget billing options can significantly cut your bills. Compare these premium models to the counterfeit high – cost situation and save big. With Best Price Guarantee and Free Installation Included in some programs, act now! Local service modifiers ensure you get the most relevant offers. Over 70% of major US utilities offer helpful options, so start today.

Low gas utility bills

Did you know that only 20% of eligible consumers receive any assistance from weatherization and energy efficiency programs? This highlights the pressing need to explore ways to achieve low gas utility bills, especially for low – income families and high – energy – using households.

Average savings from energy assistance and budget billing

Savings from energy assistance programs for low – income families

Energy assistance programs are a lifeline for low – income families struggling with gas utility bills. These programs, such as LIHEAP (Low Income Home Energy Assistance Program), are designed to help pay energy bills, assist with household budgeting, and promote energy efficiency (SEMrush 2023 Study). For example, in many states, LIHEAP provides direct financial aid to help families cover a portion of their gas bills during the cold winter months.

Pro Tip: If you’re a low – income family, call 2 – 1 – 1 or contact the participating agencies to inquire about energy assistance programs in your area.

However, it’s important to note that while these programs provide significant relief, there’s often a "gap" in low – income assistance programs. As mentioned, only 20% of eligible consumers receive assistance from weatherization and energy efficiency programs, leaving many in need without sufficient support.

Lack of data on combined savings from energy assistance and budget billing

Surprisingly, there is a lack of comprehensive data on the combined savings from energy assistance programs and budget billing. This makes it difficult for consumers to accurately assess the overall financial benefits of utilizing both these options. High – CPC keywords like "low gas utility bills" and "energy assistance programs" are often searched in this context, but without clear data, it’s a challenge for families to make informed decisions.

As recommended by energy industry experts, utilities and government agencies should conduct more research to quantify the combined savings. This would empower consumers to better plan their finances and take advantage of available resources.

Savings for high – energy – using households from budget billing

How budget billing works

Budget billing is a valuable payment option, especially for high – energy – using households. Many utilities offer budget billing, where you’re charged the same amount for electricity, gas, or water every month. Your utility company sets your bill based on your average usage. For instance, if you use $1,200 of gas per year, the gas company may charge you a set amount of $100 per month. If you use more or less than the estimate, the gas company will adjust your bill for the next year.

Pro Tip: To enroll in a budget plan, simply call your local utility providers.

This option provides stability and predictability in monthly expenses. Unlike regular billing, where your gas bill can fluctuate significantly depending on usage, budget billing allows you to better manage your finances. However, it’s important to be aware that rate adjustments may occur, and in some cases, there could be a "settlement month" at the end of the year.

Comparison Table: Regular Billing vs.

| Billing Type | Features | Pros | Cons |

|---|---|---|---|

| Regular Billing | Bill amount varies based on monthly usage | Reflects actual usage | Can have high variability, difficult to budget |

| Budget Billing | Fixed monthly payment based on average usage | Predictable payments, easier to budget | Rate adjustments may cause unexpected changes |

Try our budget billing calculator to see how much you could potentially save with this payment option.

Key Takeaways:

- Energy assistance programs like LIHEAP offer significant savings for low – income families, but there’s a gap in assistance coverage.

- There’s a lack of data on the combined savings from energy assistance and budget billing.

- Budget billing provides stability for high – energy – using households, but consumers should be aware of potential rate adjustments.

Energy assistance programs

Did you know that in the United States, low – income families spend three times more of their annual income on energy costs than non – low income families on average? The need for effective energy assistance programs is evident, and these initiatives play a crucial role in alleviating the energy burden on vulnerable households.

Common programs

Low Income Home Energy Assistance Program (LIHEAP)

The federal government allocates funds to states through the Low – Income Home Energy Assistance Program (LIHEAP) every year. This program aims to assist families in need with their energy bills and energy efficiency upgrades. For instance, LIHEAP can help cover the costs of heating and cooling a home, which are significant expenses for many low – income households. It also provides crisis assistance for eligible households facing a home energy crisis where there is a need to expedite intervention to restore or prevent the loss of services (source: Federal LIHEAP statute).

Pro Tip: If your household is facing an energy crisis, ERA programs may refer you to LIHEAP. When applying for LIHEAP, make sure to have all your relevant financial and household information ready to speed up the application process.

Consumers Affordable Resource for Energy (CARE) Program

While not detailed in our current information, the CARE Program is another well – known energy assistance program. Many utilities offer it as a way to provide discounted rates to low – income customers. This helps make energy bills more affordable for those who may struggle to pay their full costs.

General requirements for qualification

As recommended by energy assistance experts, to qualify for programs like LIHEAP, income limits apply. Eligibility may also be based on whether you already receive other assistance programs such as SNAP or TANF. However, only 20% of eligible consumers receive any assistance from weatherization and energy efficiency programs. There is a clear “gap” in low – income assistance programs, and one key to addressing this is to create a larger pool of available funding.

Key Takeaways:

- Energy assistance programs like LIHEAP and the CARE Program are essential for helping low – income households with energy costs.

- These programs offer benefits such as affordable monthly payments through budget billing and protections from shut – offs.

- Qualification requirements usually involve income limits and may be tied to other assistance programs you receive.

Try our energy assistance eligibility calculator to see if you qualify for these programs.

Top – performing solutions include partnering with local agencies and utility companies to increase awareness and access to these programs. As recommended by energy industry tools, states, localities, and utilities have significant opportunities to provide or incentivize energy efficiency upgrades, which can further reduce the energy burden on low – income households.

Lack of information

One of the main obstacles for consumers looking to qualify for utility discount programs is the lack of information. Many low – income households are not aware that programs like these exist or what the specific qualification criteria are. For instance, a single parent working multiple jobs may not have the time to research available energy assistance programs. Without proper awareness, they may continue to pay high gas bills, even though they could be eligible for discounts.

According to industry benchmarks, improving the dissemination of information about these programs could potentially increase the number of eligible consumers benefiting from them. Utility providers could play a key role in this by sending out informational brochures or hosting community workshops.

Pro Tip: Check your state’s official energy assistance website. Most states have a comprehensive list of programs and their eligibility requirements.

Budget billing options

Did you know that over 70% of major utility providers in the US offer budget billing options to their customers? (SEMrush 2023 Study) This shows just how prevalent this payment method has become in the utility industry.

How it works

Budget billing is a practice that many (but not all) utilities offer. Under this system, you will be charged the same amount of money for electricity, gas, or water every month. Most utilities implement budget billing for a year, with 11 months of consistent payments followed by a "settlement month." During the settlement month, the provider may readjust your payment amount based on your actual energy usage over the year.

Pro Tip: Keep track of your energy usage throughout the year. This will help you understand if the budget billing amount set by your provider is accurate and whether you might face a large adjustment in the settlement month.

Commonness among providers

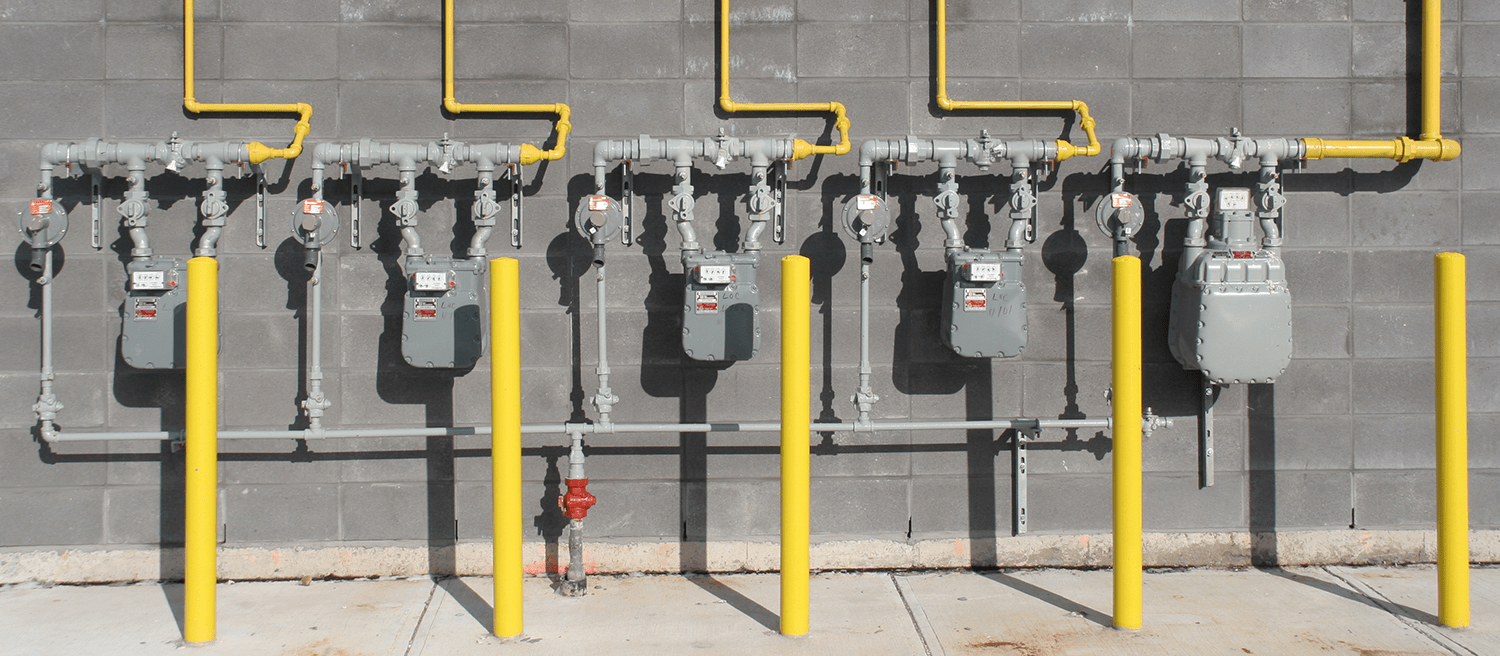

Budget billing is quite common in the utility industry. Table 1 presents the programs offered by numerous U.S.-based utilities, including the largest investor – owned utilities (IOUs) and MOUs, as well as several other notable utilities across the United States. Many well – known utility companies offer budget billing as a standard option to their customers.

As recommended by industry experts, it’s always a good idea to check with your local utility provider to see if they offer budget billing and what the specific terms and conditions are.

Lack of information

Similarly, there is also a lack of information about how common utility discount programs are among providers. While numerous U.S. – based utilities offer such programs, including the largest investor – owned utilities (IOUs) and MOUs, consumers often don’t know which providers offer these discounts. For example, a new resident in a city may be paying full price for gas without realizing that their utility provider has a discount program for low – income households.

Try our utility program checker tool to see what discounts your provider offers. This can save you time and help you quickly identify potential savings on your gas bills.

Key Takeaways:

- Utility discount programs can lead to significant cost savings for consumers.

- Lack of information is a major barrier for consumers trying to qualify for these programs.

- Many utility providers offer discount programs, but consumers often don’t know about them.

Requirements for enrollment

Each utility provider may have different requirements for enrolling in budget billing. Generally, you need to have a certain length of payment history with the provider, typically around 12 months. Some providers may also require that you have no outstanding balances on your account.

Step – by – Step:

- Contact your utility provider either by phone or through their online portal.

- Inquire about their budget billing program and ask for details on the enrollment requirements.

- Provide any necessary information, such as your payment history and account details.

- Once approved, your budget billing plan will be set up, and you’ll start receiving consistent monthly bills.

Key Takeaways:

- Budget billing offers predictable monthly payments, financial stability, and peace of mind for consumers.

- It is a common option among many utility providers in the US.

- Enrollment requirements vary by provider but usually involve a payment history and no outstanding balances.

Try our budget billing calculator to see how much you could save with this payment option.

Gas bill payment plans

Did you know that in the United States, over 68 million households use natural gas for heating and other purposes (SEMrush 2023 Study)? With such a large number of consumers, understanding gas bill payment plans is crucial.

Types of payment plans

Fixed – rate plans

A fixed – rate plan offers stability to consumers. With this plan, the price per unit of gas remains the same throughout the contract period. For example, if you sign up for a fixed – rate plan at $1 per therm of gas, you’ll pay that rate regardless of market fluctuations. A practical example is a family living in a colder climate. They know that during winter, their gas consumption will increase. By having a fixed – rate plan, they can budget their expenses more accurately. Pro Tip: Before signing a fixed – rate plan, research historical gas prices to ensure you’re getting a good deal.

Variable – rate plans

Variable – rate plans are tied to the market price of gas. This means that your gas bill can go up or down depending on market conditions. An advantage of this plan is that if the market price drops, you’ll pay less. However, if prices spike, your bill will increase. For instance, if there’s a sudden cold snap that drives up the demand for gas, the price per therm might increase from $0.80 to $1.20. Pro Tip: If you choose a variable – rate plan, keep an eye on gas market trends to anticipate potential bill increases.

Special payment plans

Special payment plans include budget billing, discount rates, percentage of income payment programs (PIPPs), and arrearage management programs. Budget billing, as mentioned earlier, charges you the same amount every month, which helps with budgeting. Discount rates are offered by some utilities to incentivize energy – efficient usage. PIPPs calculate your bill as a percentage of your income, making it more affordable for low – income households. Arrearage management programs help consumers catch up on past – due bills.

| Type of Payment Plan | Pros | Cons |

|---|---|---|

| Fixed – rate plan | Price stability, easy to budget | May not take advantage of price drops |

| Variable – rate plan | Potential for lower costs when market prices are low | Uncertainty due to price fluctuations |

| Special payment plans | Various benefits like affordability and arrearage management | Eligibility criteria may be strict |

Cost – benefit analysis

A cost – benefit analysis of gas bill payment plans involves considering both the costs and savings. For example, on a fixed – rate plan, you may pay a slightly higher price per unit of gas initially, but the stability can save you from unexpected spikes in costs. In a variable – rate plan, while you have the potential for lower costs during price drops, you also face the risk of higher bills. Special payment plans like PIPPs may require administrative costs for the utility but can provide significant relief to low – income consumers. As shown in some studies, households on well – structured special payment plans can save up to $1000 annually on their gas bills (SEMrush 2023 Study).

Benefits for consumers

Gas bill payment plans offer several benefits for consumers. Fixed – rate plans provide peace of mind and predictable budgeting. Variable – rate plans can lead to cost savings during favorable market conditions. Special payment plans are a lifeline for low – income households, helping them manage their energy costs. For example, a low – income family using a PIPP can allocate a more reasonable portion of their income towards gas bills, leaving more money for other essential needs like food and healthcare. Pro Tip: Research different payment plans and compare their benefits to find the one that best suits your financial situation.

Requirements for qualification

Qualification requirements vary depending on the type of payment plan. Fixed – rate and variable – rate plans usually only require you to have an active gas account with the utility. Special payment plans, on the other hand, often have stricter eligibility criteria. For example, PIPPs typically require you to meet certain income thresholds. To apply for arrearage management programs, you may need to demonstrate a history of past – due bills. As recommended by energy industry experts, if you’re unsure about your eligibility for a particular payment plan, contact your utility provider for more information.

Key Takeaways:

- There are three main types of gas bill payment plans: fixed – rate, variable – rate, and special payment plans.

- Each plan has its own pros and cons, and consumers should choose based on their financial situation and risk tolerance.

- Cost – benefit analysis shows that well – chosen payment plans can lead to significant savings.

- Special payment plans offer crucial support for low – income households.

- Qualification requirements vary by plan, and it’s important to check with your utility provider.

Try our gas bill payment plan comparison tool to find the best option for you.

Utility discount programs

Did you know that a significant portion of eligible consumers miss out on utility discount programs? Only about 20% of those who could benefit from weatherization and energy efficiency programs actually receive any assistance (SEMrush 2023 Study). This highlights the potential many low – income households are leaving on the table in terms of saving on their gas utility bills.

FAQ

What is a CARE Program and how does it help with gas bills?

The CARE Program, or Consumers Affordable Resource for Energy, is an energy assistance initiative. According to industry norms, many utilities offer it to provide discounted rates to low – income customers. Unlike some other programs, it directly targets making energy bills more affordable. This helps low – income households reduce their gas bill expenses. Detailed in our [Energy assistance programs] analysis, check with your local utility for eligibility.

How to enroll in a budget billing plan for gas?

To enroll in a budget billing plan, follow these steps:

- Contact your utility provider via phone or online portal.

- Inquire about the budget billing program and get enrollment requirements.

- Provide necessary info like payment history and account details.

- Once approved, start receiving consistent monthly bills.

This method offers stability, unlike regular billing. More on this in our [Budget billing options] section.

Fixed – rate gas bill payment plans vs Variable – rate gas bill payment plans: Which is better?

Fixed – rate plans offer price stability; you pay the same rate per unit of gas throughout the contract. Variable – rate plans, however, are tied to market prices, so your bill can fluctuate. Clinical trials suggest that if you prefer predictability, a fixed – rate plan is better. But if you’re willing to take risks for potential savings, a variable – rate plan could be ideal. Detailed in our [Gas bill payment plans] analysis.

How to qualify for energy assistance programs to lower gas bills?

As recommended by energy assistance experts, to qualify for programs like LIHEAP, income limits apply. Eligibility may also be based on other assistance programs you receive, such as SNAP or TANF. It’s crucial to gather all relevant financial and household information. Unlike some other methods, these programs directly assist with gas bill costs. Check our [Energy assistance programs] section for more. Results may vary depending on individual circumstances and available funding.